1-800-747-1420

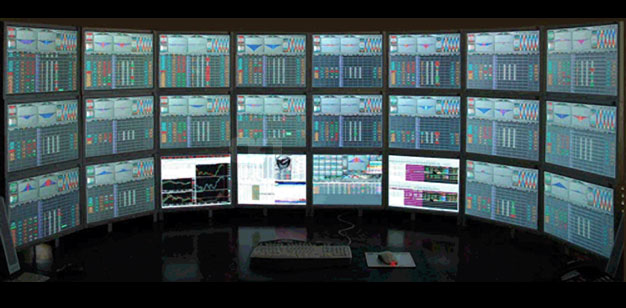

With technology growing rapidly around the globe, traders are looking for a fast and easy way of implementing automated and algorithmic methods of trading. It is difficult, if not impossible, for an individual to make lightening fast decisions when it comes to trading. By using a trading system, an investor can potentially overcome some of the obstacles of staying “glued” to the market, and manually entering trades on their own. It may be easier for an investor to look at an overall picture of a trading system, than spending hours of time analyzing individual trades for a trading account. Computerized algo-trading has become a new and popular way for traders to participate in the ever growing fast paced financial markets.

With over 21 years of experience, we believe we have found what system traders are looking for: An easy and convenient way to scan, research, and implement a trading system that meets each trader’s criteria.

With over 21 years of experience, we believe we have found what system traders are looking for: An easy and convenient way to scan, research, and implement a trading system that meets each trader’s criteria.

All of our offered trading systems have the commission and fees factored into every trade reported. This is an important metric that sets our offered trading systems apart from other trading systems on the internet. Whether it is a back tested trade, tracked trade, or a real trade in a client’s account, you can be confident the results being reported are a more accurate representation of the performance of a particular trading system. Every trade in each system’s trading results already have the fees calculated and deducted, just like in a real trading account. These fees have a material impact on every trading account, and we feel it is important to have these reflected in every trade. Many trading systems on the internet do not factor in trading commissions and fees, which can have a significant impact upon one’s trading results.

With our innovative client portal technology, you are in complete control of your trading system. Traders can evaluate hundreds of different systems to find the right one to fit their specific needs. No more calling a broker and filling out time consuming paper-work. Once your trading system account is established, you are in complete control of every aspect of your system decisions. If you don’t like a specific system, or want to try something different, you can pick a new system from the large database and start trading it immediately.

With our innovative client portal technology, you are in complete control of your trading system. Traders can evaluate hundreds of different systems to find the right one to fit their specific needs. No more calling a broker and filling out time consuming paper-work. Once your trading system account is established, you are in complete control of every aspect of your system decisions. If you don’t like a specific system, or want to try something different, you can pick a new system from the large database and start trading it immediately.

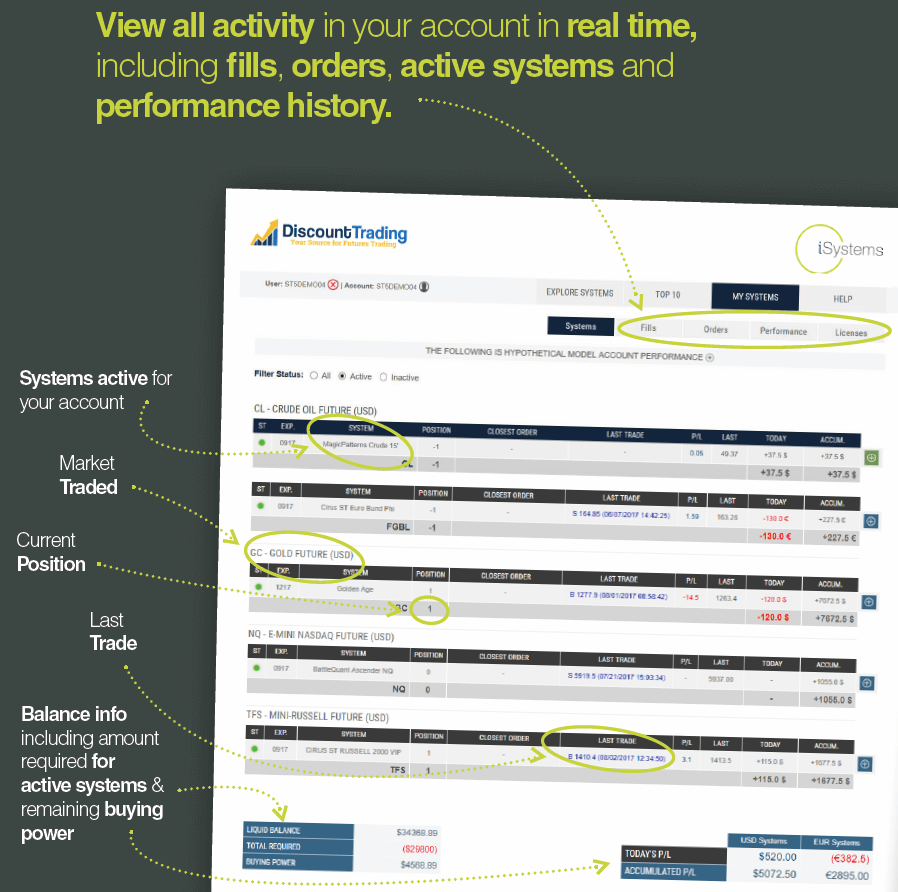

You can log into the trading system portal to see all tracked systems. The customizable performance table lists and sorts systems across profit and loss, required capital, ranking, and dozens of additional factors. You will be able to browse all systems, top 10 tables, and also your current active systems. You can use quick filters to find top systems, or build your own advanced filter logic across dozens of metrics.

View all activity in your account in real time, including fills, orders, active systems and performance history. With the easy to use client portal, you can turn on or off a trading system whenever you want. Want to take a profit on a particular trade? You can do that from the client portal. Want to stop a particular trading system when the current trade is closed? You can also do that from the client portal. Want to trade a different system than the one you are currently using? You will be able to see updated results of all the trading platforms, and have the ability to add or switch systems whenever you like.

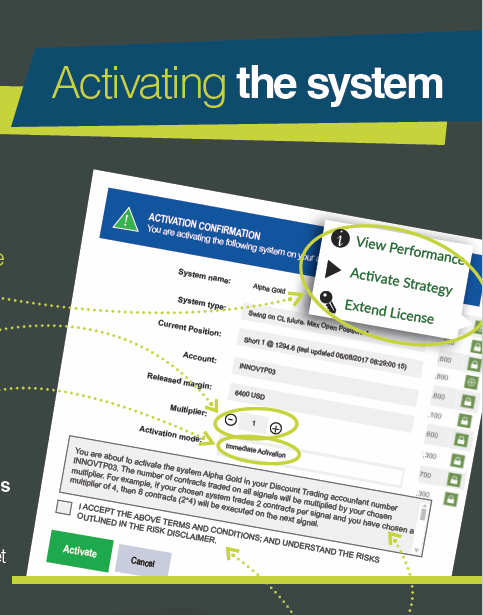

Once an account is open and a subscription is in place, the system can be activated. Clients license the rights to system signals paying a monthly ‘license fee’. You can select how many units of the system you want to trade, typically, 1 unit = 1 contract / per signal. The cost of the system is deducted from your account at the beginning of each month, and is prorated during the first month activated. You can choose different activation options depending on whether the system is currently in a trade and where the market is in relation to its latest entry price. All activations on the portal require a ‘double check’ before proceeding. You have complete 24/7 control, with ability to start, stop or change systems at any time. Computers with access to the trading signals make sure your trades get executed automatically.

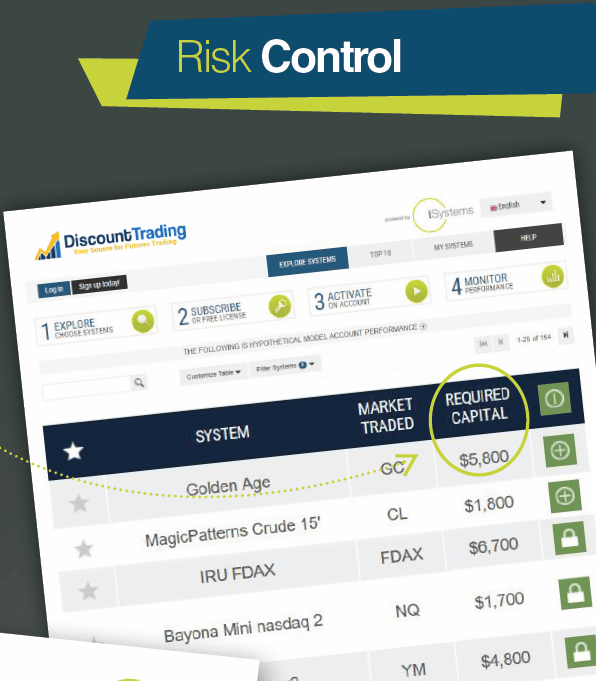

At the heart of the client portal is risk control. Accounts need at least the ‘Required Minimum’ in their account to activate a system. Balances are synced each day and then updated in real-time based on the systems’ profit and losses. Our smart algorithms will automatically deactivate a trading system if your balance drops below the required minimum, and will also notify you via email.

Diversifying with more than one system could help balance risk. Any one system may be subject to the risk of an individual market or an individual sector. By trading multiple systems across different markets or different sectors, one may possibly reduce market specific and complex specific risk. By trading systems with different entry and exit strategies, different markets, and different algorithms, the trader may reduce system specific risk associated with utilizing one trading system. With any type of futures trading, the risk of trading can be substantial and each investor or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results, and this is no different with system trading.

NOTICE: "HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.